Peloton Q2 FY2026 Earnings Reveal Challenging Revenue Decline Amid Growth Efforts

Peloton Interactive, Inc. released its financial results for the second quarter of fiscal year 2026 (Peloton Q2 FY2026 earnings) on Thursday, presenting a picture of a company balancing operational discipline with an aggressive innovation roadmap. While revenue dipped slightly below expectations, the company reported significant improvements in profitability and gross margins, signaling that its restructuring efforts and strategic pivot toward the commercial sector are gaining traction.

CEO Peter Stern described the quarter as “the most substantial period of innovation at Peloton since our founding,” pointing to a stabilized balance sheet and new product offerings as evidence that the fitness technology company can simultaneously manage costs and drive development.

Financial Performance in Peloton Q2 FY2026 Earnings

For the quarter ended December 31, 2025, Peloton reported total revenue of $657 million. This represents a 3% decrease year-over-year and fell $8 million below the company’s guidance range. The revenue miss was primarily attributed to lower-than-anticipated hardware sales to existing members, suggesting that the upgrade cycle for current subscribers remains slower than projected.

Despite the top-line pressure, Peloton demonstrated strong efficiency improvements:

- Adjusted EBITDA: The company reported $81 million in Adjusted EBITDA, a 39% increase year-over-year and $6 million above the high end of their guidance.

- Gross Margin: Total gross margin expanded to 50.5%, an increase of 320 basis points year-over-year.

- Net Loss: The GAAP net loss narrowed to $39 million.

- Debt Reduction: Net debt was reduced by 52% year-over-year, reflecting a strengthened balance sheet.

- Free Cash Flow: Reported at $71 million, though down $35 million from the previous year.

Paid Connected Fitness Subscriptions ended the quarter at 2.661 million. While this marks a 7% decline from the previous year, it exceeded the midpoint of Peloton’s guidance by 6,000 subscribers. Notably, average monthly churn remained better than expected following the October 1 price increases, indicating strong retention among the core user base.

Operational Achievements in Peloton Q2 FY2026 Earnings

The quarter was defined by the rollout of several key initiatives designed to deepen member engagement and diversify the company’s offerings.

AI and Software Integration

The launch of Peloton IQ introduced AI-powered personalized guidance to the platform. By the end of the quarter, nearly half of active members had engaged with the feature’s insights and recommendations. This focus on personalization appears to be driving behavior changes, with purchasing patterns shifting based on IQ recommendations.

Content Strategy

Peloton introduced the Cross Training Series, which utilizes advanced computer vision capabilities on the Plus hardware line. Additionally, the company continued to invest in its Strength category—a growing segment fueled partly by the rise of GLP-1 usage—by adding three new instructors for Yoga Sculpt and Pilates. Engagement metrics reflect these efforts, with the average workout time per subscription increasing by 7% year-over-year.

Commercial Business Unit (CBU)

The company’s integrated Commercial Business Unit, which leverages both the Peloton and Precor brands, achieved double-digit revenue growth year-over-year. The introduction of the Peloton Pro Series for fitness facilities aims to capture members outside the home, particularly in hospitality and gym settings.

Strategic Challenges in Peloton Q2 FY2026 Earnings

While profitability metrics improved, Peloton faces ongoing challenges in reigniting top-line growth. The primary headwind in Q2 was the reluctance of existing members to upgrade their equipment. Management noted that while the original hardware’s durability is a positive for consumer trust, it lengthens the replacement cycle, impacting hardware revenue.

Additionally, the company is navigating a restructuring process involving the shift of certain operations to lower-cost locations and partners. This move incurred approximately $28 million in restructuring costs during the quarter but is expected to support the company’s goal of a more flexible capital structure.

Outlook and Future Priorities

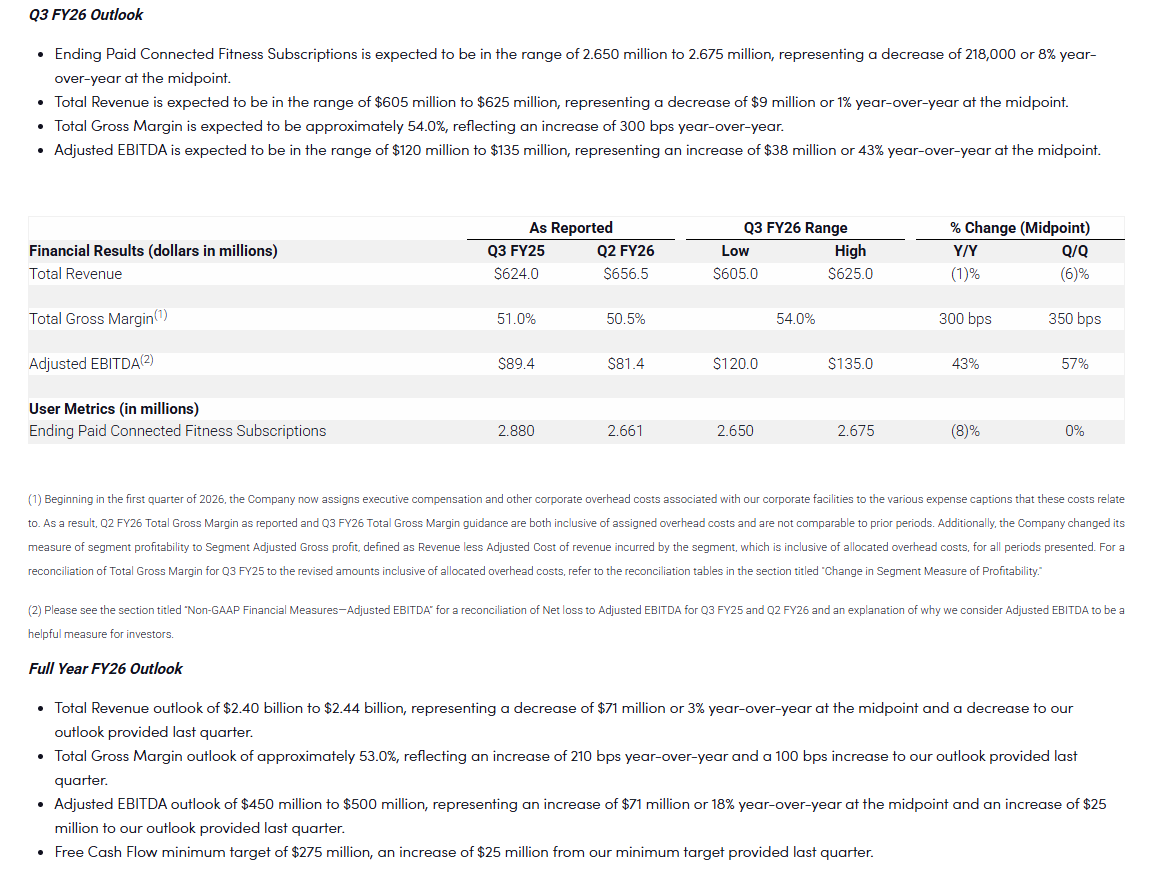

Looking ahead to Q3 FY2026, Peloton forecasts revenue between $605 million and $625 million, with Adjusted EBITDA expected to range from $120 million to $135 million. The outlook assumes a continued year-over-year decrease in subscriptions but projects a gross margin increase to approximately 54.0%.

Strategic priorities for the remainder of the fiscal year include:

- Global Expansion: Management emphasized a path to growth through global markets, although specific details remain forthcoming.

- Commercial Growth: The company views the commercial sector as a significant “new vector for growth,” planning to leverage Precor relationships to place Peloton equipment in more hotels and gyms.

- Retail Efficiency: The shift from legacy showrooms to “microstores” is yielding results, with these smaller footprints driving significantly higher sales per square foot.

As the company continues its search for a new CFO following the announced departure of Liz Coddington, the focus remains on executing a strategy that balances the “magic formula” of premium hardware, software, and coaching with the financial discipline required to maintain profitability.

Tune in to The Clip Out every Friday to hear Tom and Crystal’s take on this and other hot Pelotopics. We’re available on Apple Podcasts, Spotify, Google Podcasts, iHeart, TuneIn. Be sure and follow us so you never miss an episode. You can also find the show online on Facebook.com/TheClipOut. While you’re there, like the page and join the group. Lastly, find us on our YouTube channel, YouTube.com/TheClipOut, where you can watch all of our shows.

See something in the Peloton Universe that you think we should know? Visit theclipout.com and click on Submit a Tip!

Latest Podcast

Subscribe

Keep up with all the Peloton news!