Peloton FY25 Q4 Earnings Call: Positive Cash Flow and Innovations Ahead

Peloton FY25 Q4 earnings showed encouraging signs of a turnaround, with improved cash flow, lower debt, and bold strategic shifts aimed at transforming the platform into a total wellness ecosystem. In today’s shareholder letter and fourth-quarter earnings call, CEO Peter Stern painted a picture of a leaner, more focused Peloton—with investments in AI, strength training, recovery tools, and international expansion—all while signaling pricing changes and workforce restructuring.

Overall, the FY25 Q4 earnings letter and call were full of a lot of good news, with a year over year reduction in the company’s operating expenses and a 43% reduction in net debt. However, the call included several references to a restructuring that is taking place today and will cut personnel as well as focusing on “relocation” of current personnel in terms of where they work. There were no specifics given regarding who might be cut. 50% of the planned cuts will be implemented today with the remaining cuts coming later on.

Further, as there have already been rumblings about price increases, the presenters continued to be vague about exactly what Peloton has planned in this area, but it was pretty clear that price increases will happen at some point in the near-ish future. CEO Peter Stern indicated that the company already offers a great service to its members and that the best time to announce a price change will be once added value is announced – so most likely when new innovations are announced (which, as discussed below, will be before the holidays), prices will definitely change.

Peloton FY25 Earnings: From Restructuring to Wellness Innovation

Stern kicked off the letter and the earnings call with a bold promise of a broader company strategy focused on total wellness: Peloton is redefining what it means to live well. He pointed out that for the “younger crowd,” health is no longer about just living longer—it’s about living stronger, happier, and healthier. The company’s big goal? To support your whole wellness journey, from cardio and strength to sleep, mental health, recovery, nutrition and even hydration, and to enhance not just longevity but “healthspan.” In the United States, we’re living longer but not healthier, and stress and our eating habits add to that problem – Peloton wants to help us in all of those areas.

Peloton’s goal is to keep members hooked on the company and using its resources, not just signed up. Gamified onboarding will make members’ first weeks feel like a fitness video game. Loyalty rewards are coming (think: badges, perks, discounts) aiming to keep members hooked not just signed up. There will also be more social features, like instructor-led teams features, on the way to boost engagement and motivation (whose team will you join?)

Stern and his team hinted numerous times at new products and innovations that will be released before the holidays – they seemed to be focusing on AI for strength, more personalization of workouts and syncing those functions with health data, and some new innovation related to mediation and sleep (described as a “mix of software and human coaching.”) Stern also indicated that cardio is what Peloton is trusted for and that innovations in cardio (which is also important for longevity) will continue as well. Peloton believes that it is already the number one strength subscription service (with two million members!) Over 1.2 million of us use Peloton’s sleep content (good sleep leads to good health). 400,000 of us use Peloton’s mental wellness classes.

Peloton FY25 Q4 Earnings Show Financial Rebound

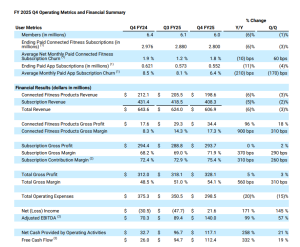

Peloton reports that it has exceeded all key financial performance goals for fiscal year 2025. The call and letter reported the company’s top wins for fiscal year 2025 as follows. A 320 million dollar positive cash flow (yes, positive!) thanks to cost cuts and leaner operations. The company’s net debt dropped by 43%. Total gross profit was $328.1 million this quarter, an increase of $16.1 million or 5% year-over-year. The connected fitness margin was up 13.6%, which is a huge improvement over previous years.

Despite a drop in subscriptions, net income in Q4 was surprisingly solid with a $21.6 million gain in net income, as opposed to a $30.5 million loss in quarter 4 of fiscal year 2024. Free cash flow was up 332%. Peloton is cutting costs in advertising, music subscriptions, and personnel, so operating expenses dropped 20% year over year. Peloton admits still experiencing financial challenges, including expected declines in hardware sales and paid subscriptions, although these were partially offset by Precor growth and monetization improvements.

The Tariff Effect

Workout time per member grew 4% – congratulations to all of us for sweating more than ever and prioritizing our health. Both Stern and Liz Coddington, the company’s CFO, indicated that a focus of cost savings will be lowering stock based compensation for employees. Also mentioned were how the newly implemented tariffs could affect pricing – tablets for the equipment are imported from Taiwan and China. Although computers are currently exempt from tariffs, Taiwan may implement a reciprocal tariff that could affect prices, and the aluminum content that is used in equipment is subject to a 50% tariff.

Peloton indicates that it is focusing on smarter pricing and expert assembly fees – we love this, as purchasing equipment this expensive should result in the equipment being set up properly and being ready to go on the first day you have it. Peloton is also offering special pricing for heroes such as teachers, military, first responders and medical pros.

For the year ahead, Peloton is cautious but optimistic. Total revenue did drop from $2.4 Billion to $2.5 billion, but the company has a free cash flow target number of $200 million. The company expects Quarter 1 of 2025 to be a bit softer due to seasonal churn and expected lower hardware sales, but Stern and his team are confident that long-term growth is in sight.

Meeting Members Everywhere

To grow again, Peloton is not waiting for people to come to Peloton— the goal is to take Peloton to the people. Peloton will expand its retail offerings from 2 (in Nashville and Utah) to 10 microstores before the holidays. The company is also expanding its recently rolled out “Peloton Repowered” campaign – providing pre-owned equipment across the United States, allowing people to have lower price options for equipment. (Currently 3 cities have this service – Peloton hopes to expand this to a national reach). Peloton is also hoping to expand internationally with local languages, AI dubbing, and smart music licensing.

Precor, Peloton’s commercial fitness brand, is doing great and serves 80,000 gyms globally, with Peloton being in 20,000 more facilities. Peloton is adding personnel to focus on this partnership, working on unifying its commercial business unit to combine Peloton and Precor offerings.

Stern’s Final Word

Stern closed the letter by thanking Peloton’s members and team, promising that the best is yet to come. The vibe of the call was optimistic, energized, and focused on long-term wins. Keep it going, Peloton – we’re all counting on you to be a huge part of our health and wellness journeys!

Tune in to The Clip Out every Friday to hear Tom and Crystal’s take on this and other hot Pelotopics. We’re available on Apple Podcasts, Spotify, Google Podcasts, iHeart, TuneIn. Be sure and follow us so you never miss an episode. You can also find the show online on Facebook.com/TheClipOut. While you’re there, like the page and join the group. Lastly, find us on our YouTube channel, YouTube.com/TheClipOut, where you can watch all of our shows.

See something in the Peloton Universe that you think we should know? Visit theclipout.com and click on Submit a Tip!

Latest Podcast

Subscribe

Keep up with all the Peloton news!